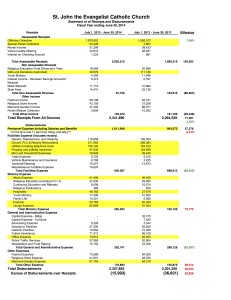

Below, please find a link to our consolidated statement of receipts and disbursements for the recently completed fiscal year (July 1, 2013 – June 30, 2014) with a comparison to the prior fiscal year (July 1, 2012 – June 30, 2013.) The remainder of my column will be dedicated to discussion of the statement with explanations of any variances which I feel need explanation. I have highlighted the line items for discussion in yellow.

St John Parishioner Fiscal Year End Report 6-30-14

I will begin the discussion by saying THANK YOU to all of our parishioners for your incredible generosity. You will notice on the first line item that we recognized a nearly 8% increase in regular offertory over the prior year. This is the second consecutive year that we have recognized such a gain.

On the second line entitled “Special Parish Collections,” the majority of this revenue is from the Capital Reserve special collection administered in March of this year. Although listed under assessable receipts, the funds received for the capital reserve fund are restricted and have been deemed non-assessable.

The final highlighted line item on the income side references “Gifts and Donations (restricted).” Included in this revenue are donations for the new sound system and for the new parish van, to make its debut in September.

On the expense side, I will also begin with the first line item which is Personnel Expense. Salary increases for the lay staff were issued for the first time in four years in 2013/2014. In addition, pension benefits for the clergy increased substantially over the prior year. The employer portion for health benefits also increased marginally due to changes in the plan structure.

The largest expense line item outside of personnel is for renovations in the Church, PLC and CFC. Included is the installation of several of the new PLC AC units, Metasys controls for the church and PLC AC units, new front doors on the church, campus wide surveillance system and fiber optic cable installation.

The utilities line item includes expenses incurred for the installation of our new telephone system. Recognized are substantial expenses to run cable in all three buildings allowing us to operate a “voice over IP” system. After substantial up front expense for the phone system, we will recognize savings moving forward. In addition, with the new PLC AC units in place and the connection of all units to Metasys, we should be in very good shape in the near future.

Due to a change in the billing cycle, we recognized two annual payments for property and liability insurance in 2012/2013. Although there was a rate increase, the expense listed is the annual premium for 2013/2014. We do receive a 3% discount for paying the entire premium in full prior to September 30th.

Rent expense decreased substantially following the purchase of a condominium for one of our associate priests.

The variance in music expense compared to the prior year is directly related to the purchase and installation of our new wireless sound system. There was also a large expenditure for the purchase of a new library of sheet music for the choir.

Hospitality expense increased substantially over the prior year mainly due to the Diocese of Venice requesting that I reallocate certain expenses to better reflect their standardized chart of accounts. Included in Hospitality expense is the coffee and refreshment service after Mass each and every Sunday and linen rental for parish special events.

Pastoral expense includes parish related events which are pastoral in nature. Once such event is taking place this weekend when Fr. John is taking the Altar Servers to Busch Gardens for a well-deserved thank you for their hard work and dedication.

Liturgy expense includes all of the liturgical supplies needed for the celebration of Mass. Included are the votive candles for the stands in front of the Blessed Mother and St. John the Evangelist. Also included are wine, host and laundering of vestments, altar cloths, etc… The large variance is due in part to the purchase of our new missal which will be used for three years.

Office expense includes numerous line items ranging from Information Technology to payroll fees and credit card fees. Due to the transition of our computer server to “the cloud” we recognized substantial up-front costs which will be mitigated as we move forward. We also purchased new asset inventory software to track the inventory of the entire campus. By moving our IT maintenance in-house, we will now recognize substantial savings year after year.

Finally, memorial garden expense may be directly attributable to the purchase of new granite markers. We will recognize one more large expenditure this fiscal year after which the project will be completed. I think everyone will agree that the memorial garden now looks very aesthetically pleasing.

Although we recognized a small loss ($16,000.00) for the fiscal year, we accomplished great things in 2013/2014. With better budgeting and planning for this fiscal year, we hope to finish the 2014/2015 campaign “in the black.”

Thank you again for your continued support and generosity.

In His work together,

Scott Schlossberg, MBA

General Manager

St John Parishioner Fiscal Year End Report 6-30-14